Boost Your Score: Efficient Methods for Credit Repair Revealed

Boost Your Score: Efficient Methods for Credit Repair Revealed

Blog Article

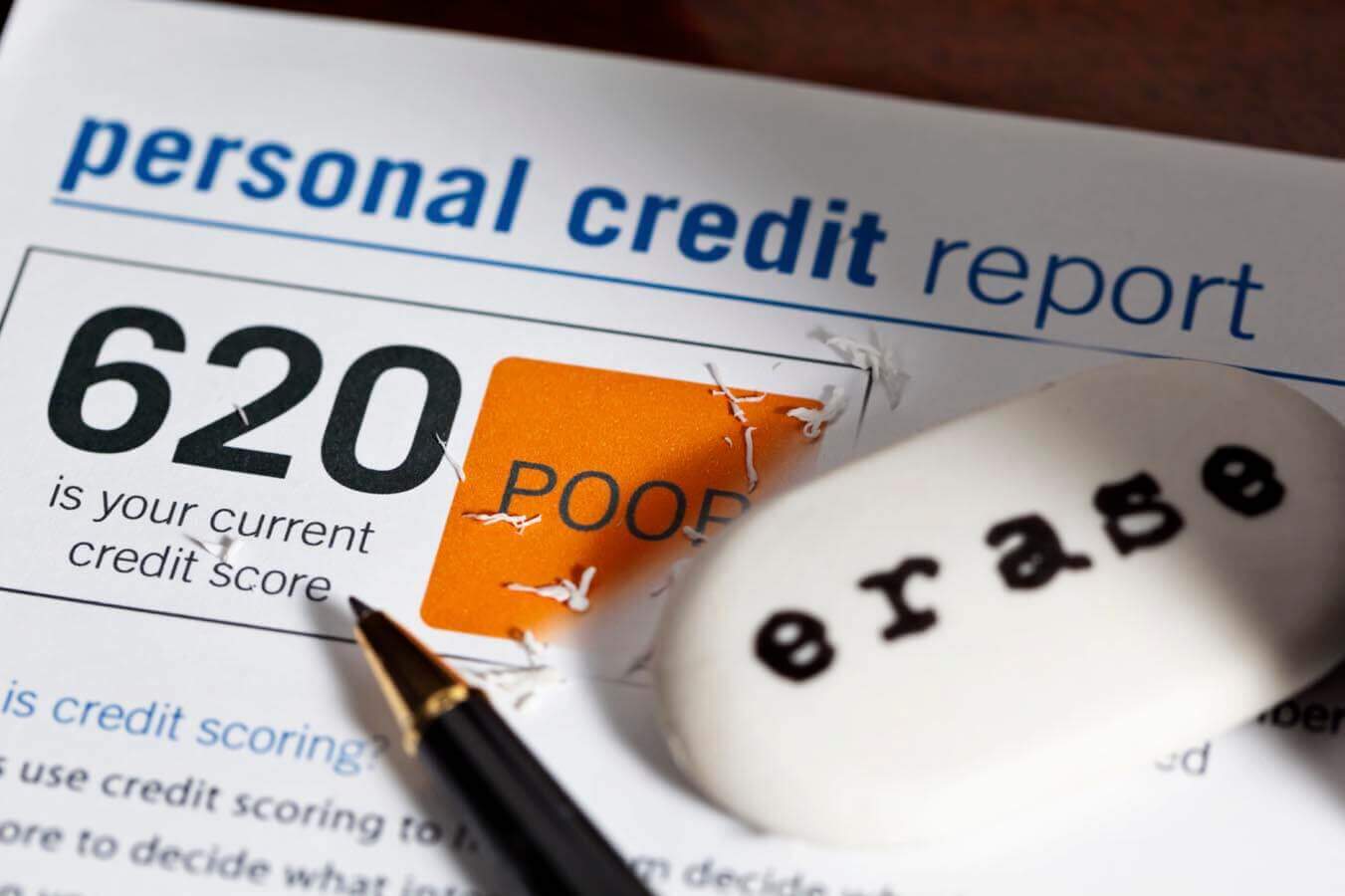

Exactly How Credit Rating Repair Service Works to Eliminate Errors and Increase Your Creditworthiness

Credit scores repair is a crucial procedure for people seeking to boost their credit reliability by addressing inaccuracies that might endanger their monetary standing. By meticulously checking out credit records for usual mistakes-- such as inaccurate individual information or misreported payment backgrounds-- individuals can initiate an organized dispute process with credit history bureaus.

Recognizing Credit News

Debt records serve as a financial snapshot of a person's credit report, detailing their loaning and payment habits. These reports are assembled by credit score bureaus and include critical details such as credit report accounts, arrearages, settlement background, and public documents like liens or bankruptcies. Monetary establishments utilize this data to analyze an individual's creditworthiness when requesting lendings, bank card, or mortgages.

A credit history report normally consists of individual details, including the individual's name, address, and Social Protection number, in addition to a list of debt accounts, their condition, and any type of late repayments. The record additionally lays out credit queries-- circumstances where lending institutions have accessed the report for analysis functions. Each of these parts plays a vital role in figuring out a credit report, which is a numerical representation of credit reliability.

Comprehending credit history reports is vital for consumers intending to manage their economic health and wellness properly. By on a regular basis evaluating their reports, individuals can make sure that their credit rating precisely mirrors their monetary behavior, therefore positioning themselves favorably in future loaning ventures. Recognition of the components of one's credit score record is the very first step toward successful debt repair work and total financial health.

Typical Credit Rating Record Errors

Errors within credit score records can dramatically affect an individual's credit rating and general financial health. Usual credit record errors consist of wrong individual info, such as wrong addresses or misspelled names. These discrepancies can bring about confusion and may impact the assessment of creditworthiness.

Another regular error entails accounts that do not come from the individual, often arising from identification burglary or inaccurate information entry by creditors. Blended data, where one individual's credit report information is incorporated with another's, can additionally happen, particularly with individuals that share comparable names.

In addition, late repayments might be incorrectly reported due to refining misconceptions or errors regarding payment days. Accounts that have actually been worked out or repaid might still look like impressive, further making complex a person's credit report account.

Moreover, mistakes relating to credit line and account equilibriums can misrepresent a consumer's credit report utilization ratio, an important element in credit rating. Acknowledging these mistakes is vital, as they can result in higher rate of interest, financing denials, and enhanced difficulty in acquiring credit rating. On a regular basis examining one's credit rating report is a positive action to identify and rectify these usual mistakes, therefore protecting financial health and wellness.

The Credit Score Repair Refine

Browsing the credit report repair service procedure can be a complicated task for numerous individuals seeking to improve their financial standing. The trip starts with obtaining a thorough debt record from all three major credit scores bureaus: Equifax, Experian, and TransUnion. Credit Repair. look these up This allows customers to determine and comprehend the factors influencing their credit rating

As soon as the credit scores report is assessed, individuals must categorize the information right into precise, imprecise, and unverifiable products. Accurate info should be kept, while mistakes can be objected to. It is important to collect sustaining documents to corroborate any kind of insurance claims of mistake.

Next, people can select to either deal with the procedure separately or enlist the assistance of specialist credit fixing services. Credit Repair. Specialists frequently have the proficiency and sources to navigate the intricacies of credit reporting regulations and can streamline the procedure

Throughout the debt fixing procedure, preserving prompt look at here now payments on existing accounts is essential. This shows responsible financial habits and can favorably impact credit report. Ultimately, the debt repair process is a methodical approach to identifying issues, disputing inaccuracies, and cultivating healthier economic behaviors, bring about improved creditworthiness in time.

Disputing Inaccuracies Properly

An efficient conflict process is important for those looking to remedy mistakes on their debt records. The first step involves obtaining a duplicate of your credit scores record from the major credit history bureaus-- Equifax, Experian, and TransUnion. Evaluation the report thoroughly for any type of discrepancies, such as wrong account details, outdated info, or illegal entrances.

When mistakes are identified, it is necessary to collect supporting documents that validates your insurance claims. This may include repayment receipts, financial institution declarations, or any kind of appropriate communication. Next, launch the dispute process by getting in touch with the debt bureau that provided the report. This can normally be done online, using mail, or over the phone. When submitting your disagreement, give a clear description of the mistake, along with the sustaining proof.

:max_bytes(150000):strip_icc()/understanding-the-credit-repair-process-5191890_final-ac69fafa3c3c4d9099c6e271606221b5.png)

Benefits of Credit Score Fixing

A multitude of advantages goes along with the procedure of credit score fixing, substantially affecting both economic security and general lifestyle. One of the key advantages is the potential for improved credit rating. As mistakes and errors are fixed, individuals can experience a notable rise in their credit reliability, which straight affects funding approval prices and interest terms.

Additionally, credit score repair service can enhance accessibility to positive financing alternatives. Individuals with greater debt ratings are more probable read the full info here to receive lower interest prices on home loans, vehicle finances, and personal car loans, inevitably resulting in significant savings with time. This enhanced economic flexibility can assist in major life choices, such as purchasing a home or investing in education.

With a more clear understanding of their credit history circumstance, individuals can make informed selections relating to credit history usage and management. Credit fixing often involves education and learning on monetary literacy, equipping people to embrace better investing practices and maintain their credit history health lasting.

Conclusion

In final thought, debt repair serves as a crucial mechanism for enhancing creditworthiness by attending to mistakes within credit rating reports. By comprehending the nuances of credit history records and employing reliable disagreement approaches, people can achieve greater financial health and security.

By diligently examining credit report records for typical errors-- such as incorrect personal details or misreported settlement backgrounds-- individuals can start an organized conflict process with credit history bureaus.Credit scores reports offer as an economic picture of a person's debt background, detailing their loaning and payment habits. Recognition of the components of one's credit scores record is the initial action toward effective credit report repair and general monetary well-being.

Mistakes within credit history reports can dramatically influence an individual's credit rating and general financial health and wellness.Furthermore, inaccuracies concerning credit rating restrictions and account balances can misstate a consumer's credit rating use ratio, an essential aspect in credit report scoring.

Report this page